Happy Tuesday!

What have you and your family decided to do for this year’s family vacation? For us, we have decided to take the All-American family vacation to Disney World in Orlando, Florida since we have never been before.

Each year, we make it a family goal to take a yearly vacation – as long as finances are decent.

This past year in 2017, we traded in the yearly family vacation for a family goal of trying to reach all 50 states affordably. We made it to 16! Trying to make it to 50 was completely unrealistic since we were doing it all in between school and work. Nevertheless, we tried and I don’t regret any of it.

Anywho, in 2016, we spent a week between Cave City, Kentucky and Pleasant Prairie, Wisconsin. In 2015, we spent a rainy week of broken plans and doing nothing in the Virginias and in 2014, we spent a week in Florida, exploring Orlando and Daytona Beach with the ultimate attraction being Legoland Florida in Winter Haven.

But, how are you making this happen on one income?

Well, let’s talk financial creativity!

In order to make this happen each year, I have to carefully planned out our vacations so that they are – first and foremost…affordable. I do not want to go into debt for a vacation. Do you?

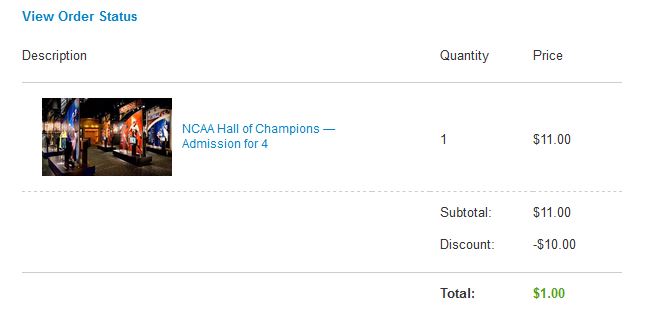

So, the first thing I do is look up discounts and deals with my first stop being Groupon.

If you have been around the blog awhile, you would know that I talk so much about utilizing Groupon for their amazing discounts. Groupon has made many of our travel adventures come true such as Legoland and the Smoky Mountains. So, I seriously check Groupon for deals before I do anything.

Signing up is absolutely free, so go head use my referral link. I appreciate you!

But, there’s another bonus with using Groupon! Not only are you already receiving a major discount on whatever it is that you are purchasing, but Groupon also sends out additional discount codes for you to save even more.

Just this weekend, Groupon sent me an additional $10 off discount code to use as long as I spent a minimum of $11. So, guess what I did?

I purchased 4 tickets to the NCAA Hall of Champions in Indianapolis. The cost on Groupon was $11. I used my $10 off discount code and scored our tickets for $1. Normally, the cost of admission is $5 per adult and $3 for youth.

Uhh, hello! Yes, please!

So, one day in the near future, when we want to do something and money may be a little funny (ummm…because we are saving for Disney), we can whip out our tickets, pack a lunch, and head to Indy for a quick, affordable, and fun day trip! Again, yes, please!

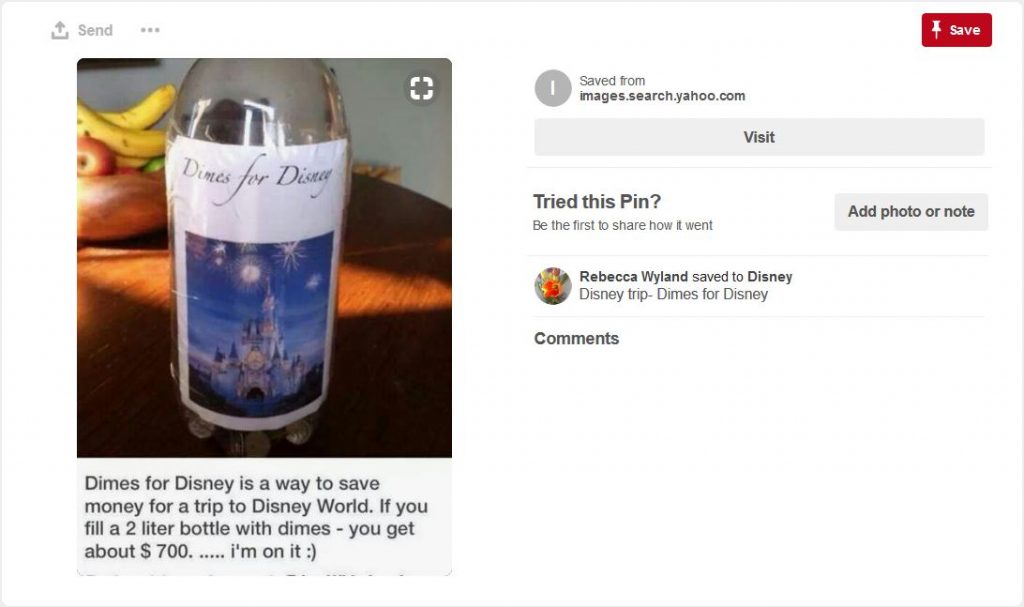

Next, I have to put a savings plan into motion as soon as the idea occurs – which brings me back to “Dimes to Disney”. Our plan to afford Disney this September is to save (2) 2-liter bottles with dimes. According to the many pins on Pinterest, saving two of these is equivalent to approximately $1400.

No, $1400 will not cover all of the expenses, but it will cover a great deal.

To make up some of the difference, I will also be purchasing Visa gift cards and Disney gift cards from Target using my Target Debit REDcard. Buying the Disney gift cards using REDcards offers an immediate 5% off when purchasing them. – Again, yes, please, and thank-you.

By the way, you can sign up for a Target REDcard and save, too!

So, imagine if I purchase one $25 or $50 gift card each time I get paid from now until September? I think our trip will be pretty much paid for. But, I’ll make updates along the way and keep you posted on how things are going.

Is Disney your only financial goal this year?

Is Disney your only financial goal this year?

Saving for Disney is not our only financial goal for the year. I have a few others, so it’s very important that I am mindful throughout the year with my finances and not creating additional debt while trying to have a great time.

Plus, I’m not here to “keep up with the Jones’”. Instead, I want us to continue to live a full life on the means that we have. But, it takes financial creativity and self-discipline. You have to know where your money is, how you spend it, and what your debt looks like.

I also believe that you should increase your income (when and as you can) and put the additional aside. For the life of me, don’t spend every penny.

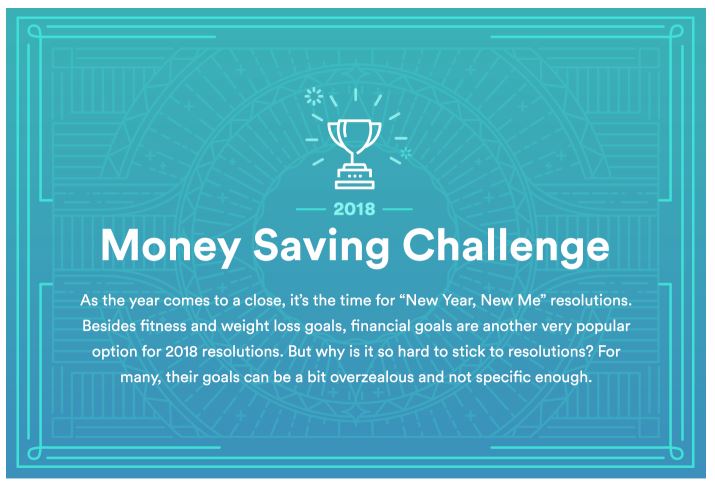

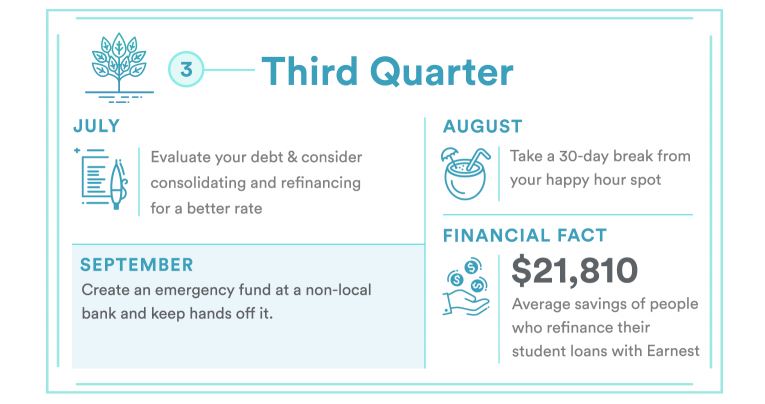

In the meantime, I hope you have enjoyed the quarter breakdowns of my financial goals throughout this post. Teaming up with Earnest help me to put my four financial goals in order for the remainder of the year with their 2018 Money Savings Challenge. I can now clearly see what is expected of me each quarter so that I am successful in reaching my all of my financial goals.

If you are interested in putting your yearly financial goals in order like me, or are battling student loan debt, check out Earnest because there are options out there to help.

This post contains referral links.

1 Comment