“Begin with the end in mind.”

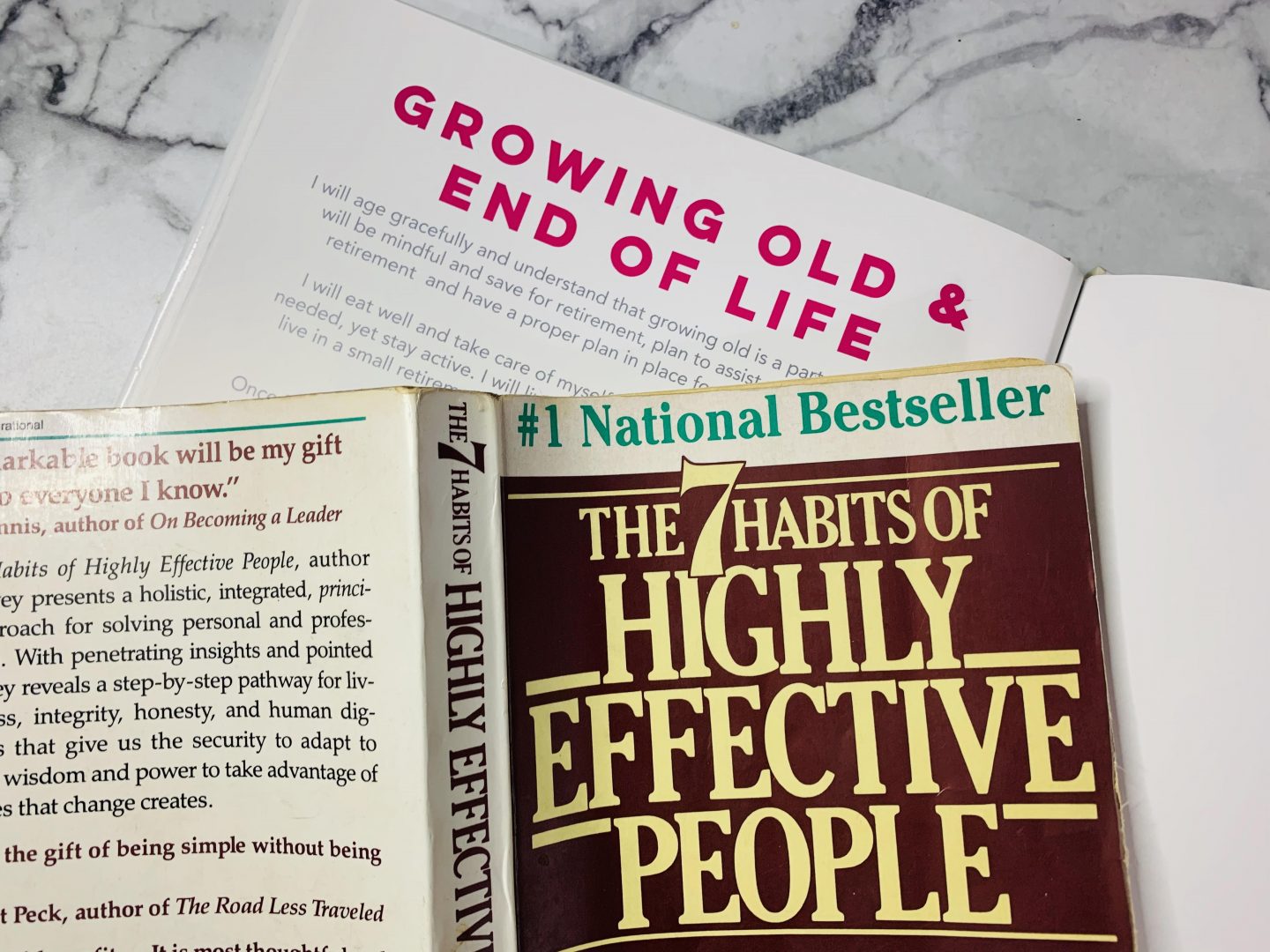

Have you ever heard of this before? If not, I’ll just tell you that it came from author, Stephen R. Covey in his book, The 7 Habits of Highly Effective People. In that book, he lists seven habits and lessons in personal change.

Habit #2 is “Begin with the end in mind.”

I read this book several years ago while completing my Master’s degree in Leadership. Of all the books that I read during that time, this book and principle #2 has always stayed with me.

In that chapter of the book, it asks you to visualize going to your funeral and seeing and hearing all the words that are said about you and how you lived your life. Pretty interesting, huh? Now, you can understand why this stuck with me.

Creating My Lifebook with the End in Mind

As I worked through creating my Lifebook, this was actually the approach that I took. I began my project with the end in mind. I sat several evenings visualizing what life looked like for me at the end of my life. After I had that image in my mind, I worked backwards in designing each of the categories in my Lifebook.

As I visualized and wrote out my visions for growing old and my end of life, I considered many factors. Some factors include finances, where I would live, would I vacation and where, how much space would I need, how I want to leave this lifetime, etc.

Retirement Living

For example, my first paragraph on that page explains that I will age gracefully and be mindful of retirement age. Later towards the middle of the page, I explain how I wish to live in a beautiful retirement community such as the estates found at Better Homes and Gardens MCR Bahamas.

Further, into that same paragraph, I discuss my financial affairs and how I plan to pay for living in the retirement community and later in an upscale assisted living facility if it comes to that.

I simply do not want my children having the responsibility of caring for me during this time, especially if they have families of their own. So, by looking at the options available such as in-home care, assisted living in Lincoln (or in another location), or a care home, I’m able to plan which is most suitable for when the time comes.

Financial Affairs

My financial plan is to have a diversified portfolio with multiple investments including an efficient mix of cash, passive income streams, real estate, stocks, bonds, etc.

Visit Bonds Express to learn more about bonds.

My hope is that I will have accumulated plenty assets, so that funding my end of life is not a financial burden on anyone. And, if needed, assets can easily be liquidated with companies such as BCI Worldwide.

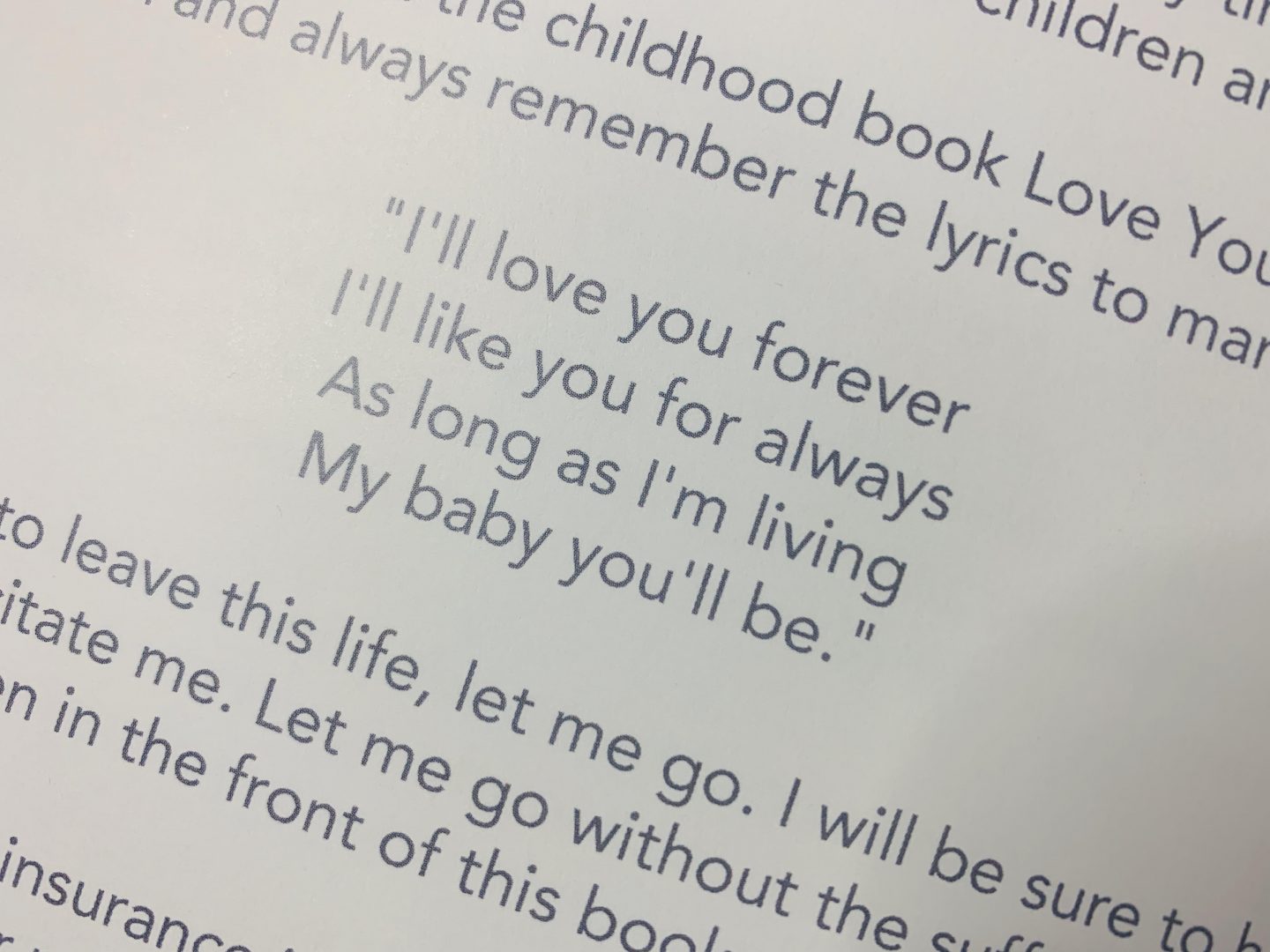

Lastly, I ended the page with a passage from the book, Love You Forever by Robert Munsch for my boys and details on my funeral.

Final Thoughts

Creating my Lifebook has been one of the best decisions that I have made this year. It has really allowed me time to think through my life beginning with the end in mind.

If you are interested in creating your own Lifebook, sign up for the Mindvalley Masterclass and get creating.

This post contains affiliate links.